pay utah sales tax online

The state sales tax rate in Utah is 4850. With local taxes the total sales tax rate is between 6100 and 9050.

Utah Legislature Passes Requirement For Online Sales Tax Kutv

Quarterly Sales and Use Tax Returns are due before 1159 pm.

. Only Pay for What You Need. Local jurisdictions also have a sales and use tax rate. Utah has recent rate changes Thu Jul 01 2021.

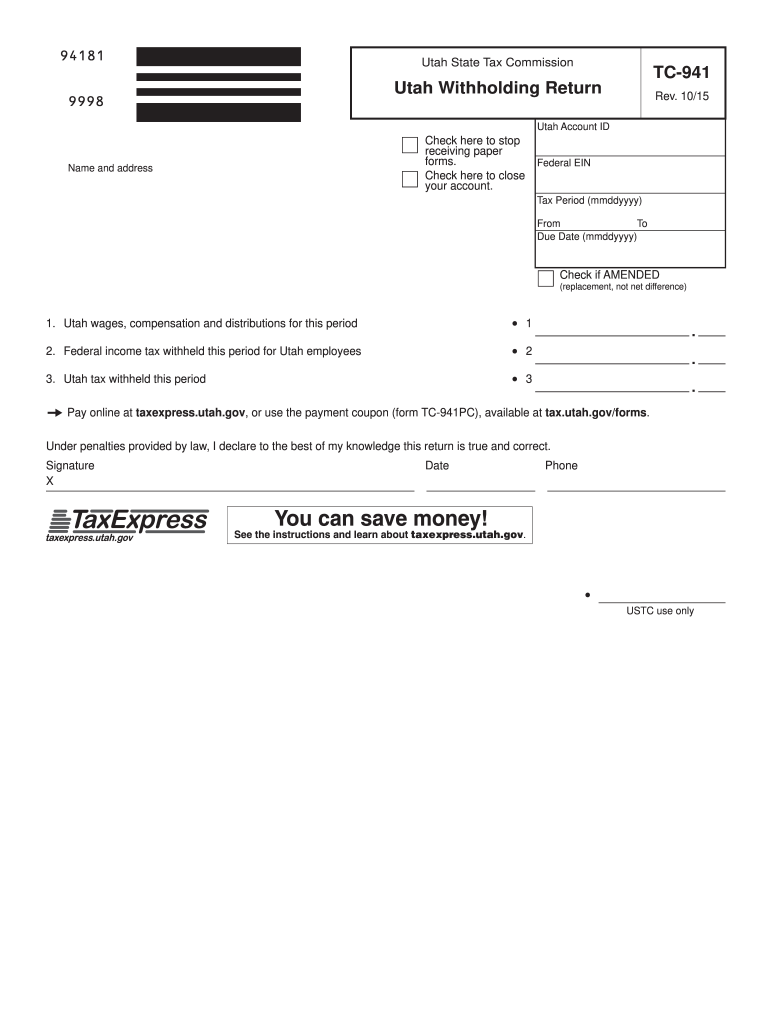

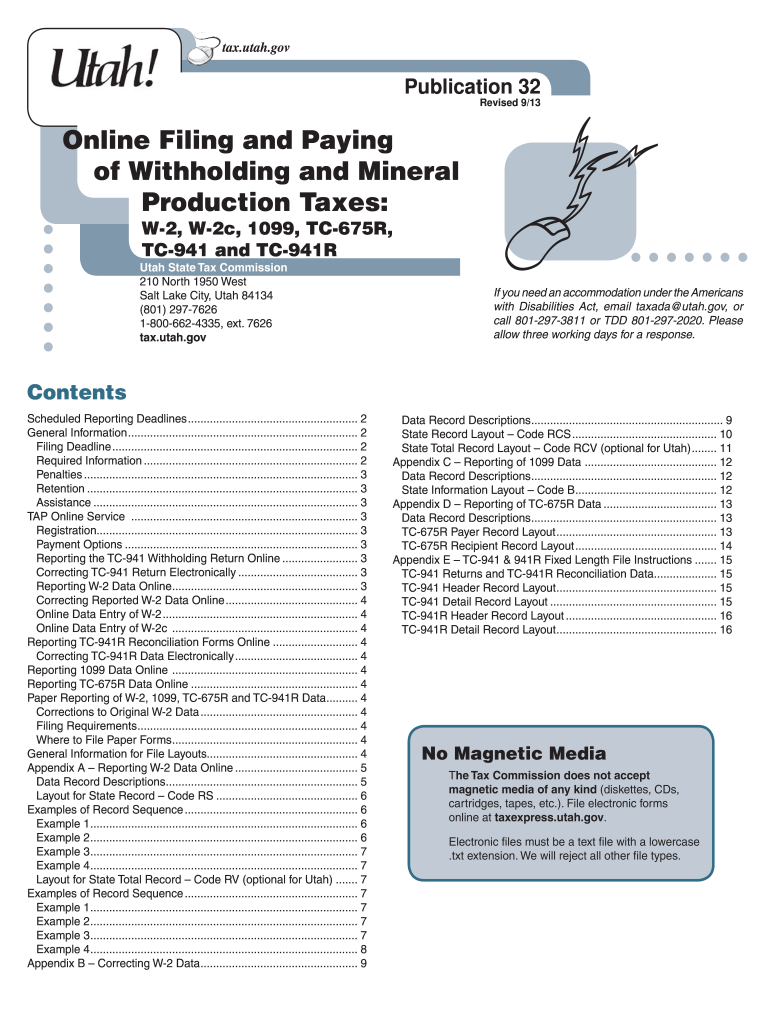

Download Or Email UT TC-62S More Fillable Forms Register and Subscribe Now. File electronically using Taxpayer Access Point at. Then click on Current Attributes.

Solve Tax for Good with end-to-end sales and use tax software. You should now be on your homepage. Write your daytime phone number and 2021 TC-40 on your check.

Filing Paying Your Taxes. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Get a personalized recommendation tailored to your state and industry.

Your property serial number Look up Serial Number. If you have a Utah sales tax licenseaccount include the use tax on your sales tax return. Ad Access Tax Forms.

What you need to pay online. Click on the period you want to file. You may request a pay plan for individual income tax online at taputahgov or over the phone at 801-297-7703 800-662-4335 ext.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. Pay over the phone by calling 801-980-3620 Option 1 for real property. Do not mail cash with your return.

Sales and Use Tax Online Filing and Payments. This means you should be charging Utah customers the sales tax rate for where your business is located. Of the 20th day of the month after the end of the filing.

This section discusses information regarding paying your Utah income taxes. File electronically using Taxpayer Access Point at. All Utah sales and use tax returns and other.

Automate sales tax preparation and filing and get back to selling with Avalara. Weve Helped Clients Ranging from Mom-and-Pop Shops to Global Publicly Traded Companies. The tax rate is.

If you are mailing a check or money order please write in your account number and filing period or use a. Ad New State Sales Tax Registration. Call Sales Tax Helper LLC Today.

Utah is an origin-based sales tax state. Ad Manage the sales use tax process from calculating tax to managing exemptions filing. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

Information about sales tax registration procedure in Utah. To pay Real Property Taxes. Additionally the state has excise and special taxes for.

Utah Sales Taxes information registration support. Call Sales Tax Helper LLC Today. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Click on Sales and Use Tax to get started. Remove any check stub before sending. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors.

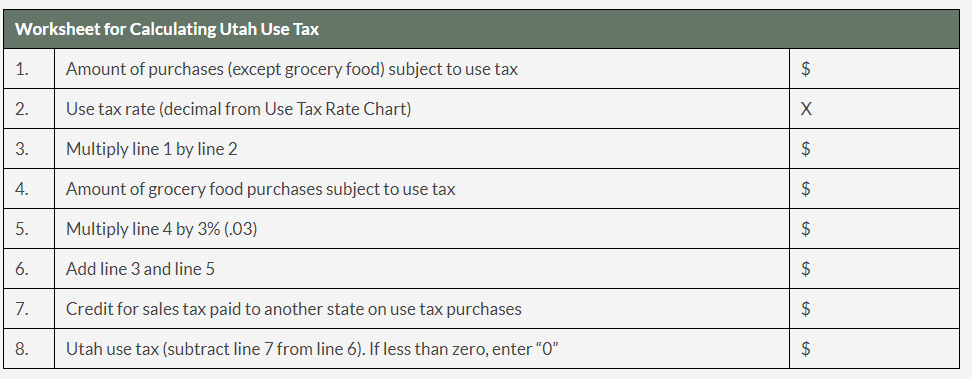

If you do not have a Utah sales tax licenseaccount report the use tax on line 31 of TC-40. This guide is for e-commerce companies selling online digital services via web stores or marketplaces. Do not staple your check to your return.

Complete Edit or Print Tax Forms Instantly. Some examples of items that are exempt from Utah sales tax are prescription medications items used in agricultural processesfuels medical equipment or items used in manufacturing. That rate could include a combination of.

You can also pay online and. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Utahs sales tax rate is 485 percent of retail goods and some services sold.

Ad A brand new low cost solution for small businesses is here - Returns For Small Business. Weve Helped Clients Ranging from Mom-and-Pop Shops to Global Publicly Traded Companies. To find out the amount of all taxes and fees for your.

Ad Find out what tax credits you qualify for and other tax savings opportunities. Only Pay for What You Need.

Utah Sales Tax Rate Rates Calculator Avalara

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

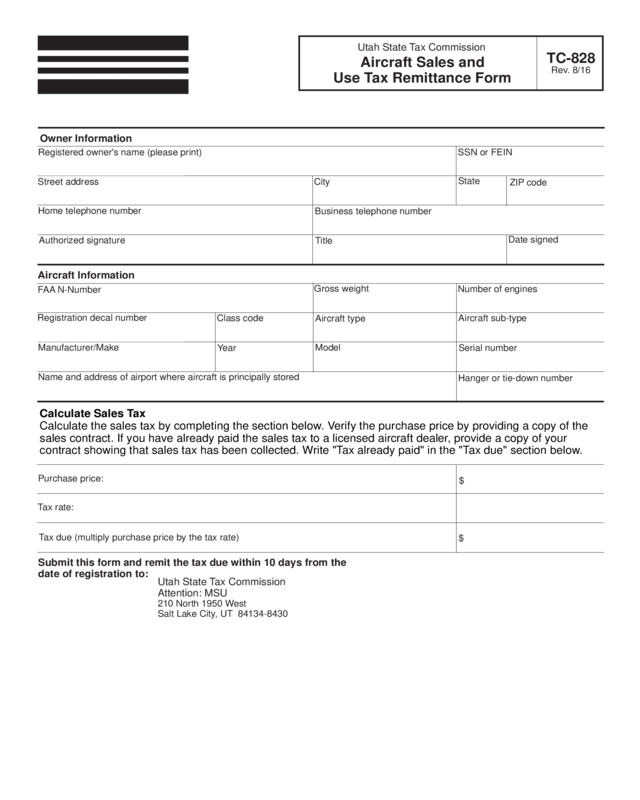

Tc 828 Aircraft Utah Sales And Use Tax Remittance Form Edit Fill Sign Online Handypdf

How To Charge Your Customers The Correct Sales Tax Rates

Ut Ustc Tc 738 2017 2022 Fill Out Tax Template Online Us Legal Forms

What Small Business Owners Need To Know About Sales Tax

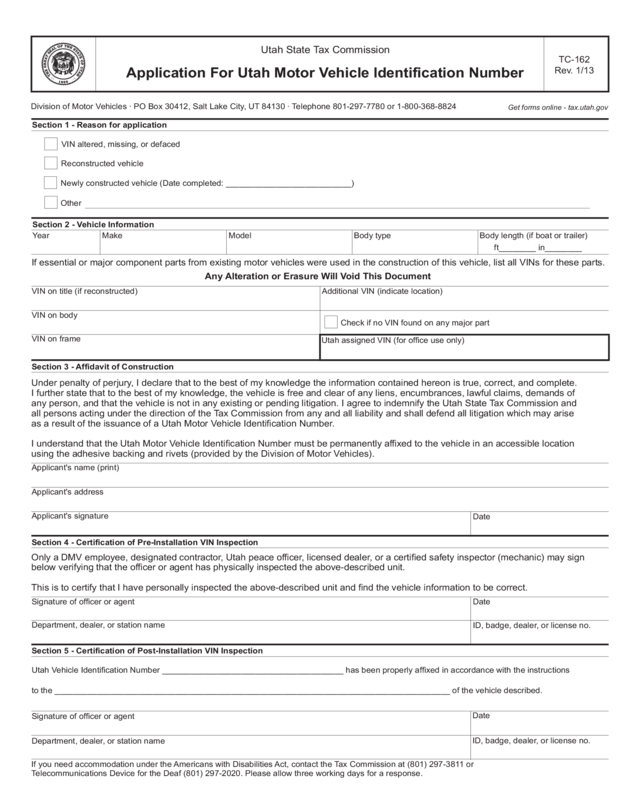

Tc 162 Utah State Tax Commission Edit Fill Sign Online Handypdf

Utah Sales Tax Proposal Should Avoid Layering Taxes On Business Inputs

Tc 941e Fill Out Sign Online Dochub

Ut Publication 32 2013 2022 Fill Out Tax Template Online Us Legal Forms

.png)

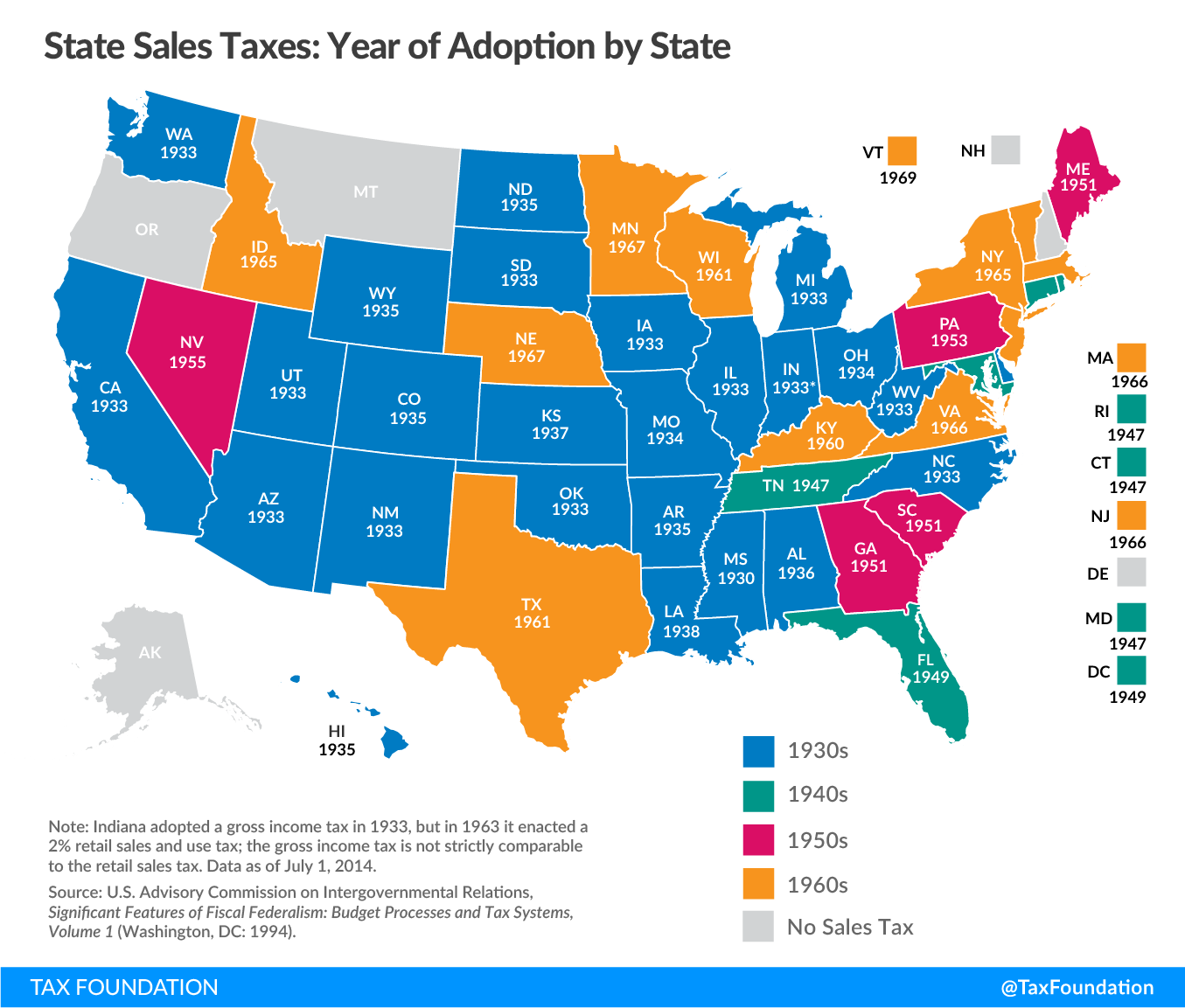

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Sales Taxes In The United States Wikipedia

General Sales Taxes And Gross Receipts Taxes Urban Institute

Your Guide To The United States Sales Tax Calculator Tax Relief Center

Sales Tax Laws By State Ultimate Guide For Business Owners

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Utah State Tax Benefits Information

Pay Your Taxes Online Dow Cpa Utah Tax And Accounting Services