nd sales tax on vehicles

There are a total of 177 local tax jurisdictions across. Taxes would be due on the purchase price based on exchange at a rate of 5.

Thursday September 9 2021 - 1000 am.

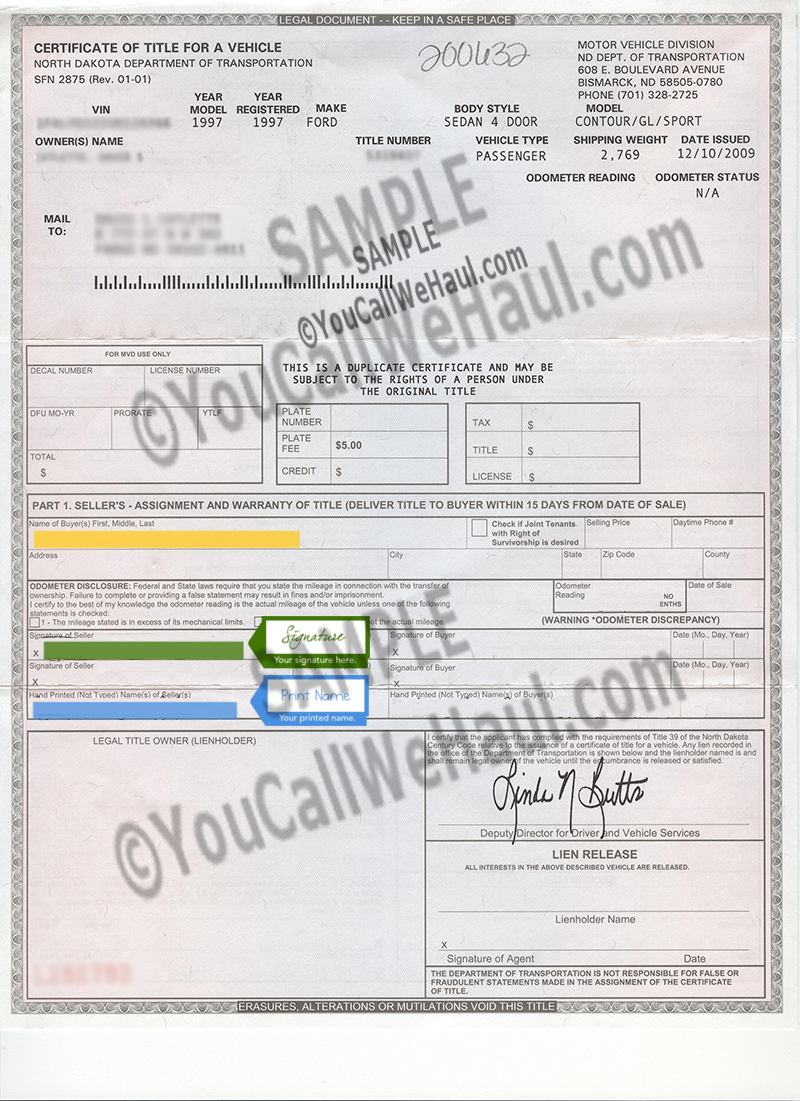

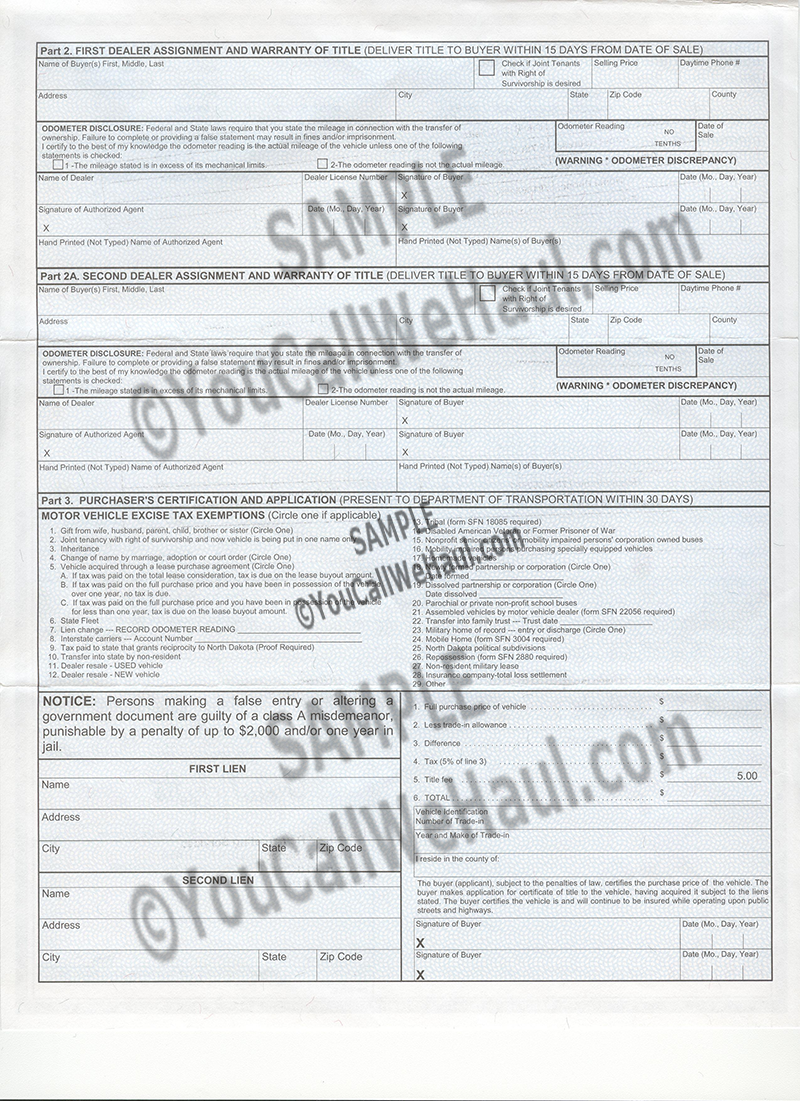

. For example if your state sales tax rate is 4 you would multiply your net purchase price by 004. Be sure the seller has signed dated and completed Part 1 including the odometer reading if the car is less than 10 years old. That state we would require proof of tax paid to exempt you from North Dakota excise tax.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Learn more about different North Dakota tax types and their requirements under North Dakota law. Gross receipts tax is applied to sales of.

Received compensation for the. Owner Telephone Number Mailing Address City State ZIP Code. The gross receipts from sales of motor vehicles required to be titled under North Dakota Century Code ch.

These guidelines provide information to taxpayers about meeting their tax. Local sales tax collections are administered under contract with the Office of North Dakota State Tax Commissioner who serves as a resource for local businesses on sales tax collection and reporting. Remember to convert the sales tax percentage to decimal format.

This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax. Will be provided for any sales tax use tax or motor vehicle excise tax paid to another state for the remaining lease period. With local taxes the total sales tax rate is between 5000 and 8500.

There is hereby imposed an excise tax at the rate of five percent on the purchase price of any motor vehicle purchased or acquired either in or outside of the state of North Dakota for use on the streets and highways of this state and required. ATTENTION DEALERS - If interested in Credit Only for ND. North Dakota has state sales tax of 5 and allows local governments to collect a local option sales tax of up to 3.

North Dakota has recent rate changes Thu Jul 01 2021. The North Dakota Office of State Tax Commissioner is the government agency responsible for administering the tax laws of North Dakota. THIS WILL CERTIFY THAT.

Cass County Sales Tax. North Dakota Department of Transportation Motor Vehicle SFN 53386 4-2020 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E BOULEVEARD AVE BISMARCK ND 58505-0780 Telephone 701328-2725 Website. To learn more see a full list of taxable and tax-exempt items in North Dakota.

All fees will be recalculated by the Motor Vehicle Division and are subject to change. 39-05 are exempt from sales tax. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 35 across the state with an average local tax of 0764 for a total of 5764 when combined with the state sales tax.

No walk-ins will be allowed. Multiply the net price of your vehicle by the sales tax percentage. Instead motor vehicle excise tax is imposed on the purchase price of any motor vehicle purchased or acquired in or outside of the state of North Dakota for use on the highways and streets of this state and.

31 rows North Dakota ND Sales Tax Rates by City The state sales tax rate in North Dakota is 5000. The rate of penalty applied to delinquent sales tax returns was changed to. In person services are provided by appointment only.

Payment options vary by branch. Qualifying vehicles entering North Dakota from another state under an optional lease period or open-end lease are subject to tax on the date the vehicle enters North Dakota for the remaining option period. If the vehicle was purchased outside of the United States there is no tax reciprocity.

The exemption is available if. 1 The Montana resident is in North Dakota to make a purchase and not as a tourist or temporary resident. You can find these fees further down on the page.

North Dakota sales tax is comprised of 2 parts. This system will provide online motor vehicle fee calculations to determine registration fees and credits as well as tax and other fees. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

Tax Commissioner Ryan Rauschenberger reported today that North Dakotas taxable sales and purchases for the second quarter of 2021 are up 212 compared to the same timeframe in 2020. This page describes the taxability of services in North Dakota including janitorial services and transportation services. North Dakota has a 5 statewide sales tax rate but also has 213 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0959 on top of the state tax.

Select the North Dakota city from the list of popular cities below to see its current sales tax rate. When you buy a car in North Dakota be sure to apply for a new registration within 5 days. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota.

Nd sales tax on vehicles. Average Sales Tax With Local. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

2 The taxable sale is 5000 or more. North Dakota sales tax law provides an exemption for certain sales made to residents of Montana. While North Dakotas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. North Dakota imposes a sales tax on retail sales. You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the vehicles age and weight.

The sales tax is paid by the purchaser and collected by the seller. Find tax information laws forms guidelines and. Sales tax was imposed on all vehicle rentals of less than 30 days at a rate of 5 and an additional 3 surcharge was imposed on vehicles weighing less than ten thousand pounds.

With respect to any lease for a term of one year or more of a motor vehicle with an North dakota nd sales tax rates by city. Cass County Government currently has a one-half percent local sales tax authorized by county voters for flood control measures. Apportioned vehicles can not be calculated by this system.

In addition to taxes car purchases in North Dakota may be subject to other fees like registration title and plate fees. North Dakota Sales Tax. Schedule an appointment online or by calling toll free 1-855-633-6835.

NDDOT is following ND Smart Restart guidelines to ensure we are safely serving our customers.

Plaza Toyota How To Drive Efficiently In New York Visual Ly Driving Economy Cars Fuel Economy

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

North Dakota Title Transfer Etags Vehicle Registration Title Services Driven By Technology

What S The Car Sales Tax In Each State Find The Best Car Price

Free North Dakota Bill Of Sale Forms Pdf

Used Cars For Sale Williston Red Rock Ford

Pin By Space Frame Graca Gaspari On Mg Advertising British Cars Cool Cars Mg Midget

Dodge Avenger Battery Size 2 Things You Most Likely Didn T Know About Dodge Avenger Battery Dodge Journey Dodge Avenger Chrysler Town And Country

Pin By Rick Erickson On Austin Healey Sebring 5000 Bmw Bmw Car Sebring

Florida State Police Miata This Must Belong To A Female Cop Miata Police Cars Mazda Miata

How To Transfer North Dakota Title And Instructions For Filling Out Your Title

Nhl Toronto Maple Leafs 2 Pc Carpet Car Mat Set 17 X27 Nfl Car Car Mats Car Floor Mats

News On Launch Of Toyota Fortuner 2 5 L By Car Zoom Http Carzoom In News On Launch Of Toyota Fortuner 2 5 L 201 Toyota Mitsubishi Pajero Sport Audi Cars

2009 Ford Edge For Sale In Frankfort Il Offerup Ford Edge Ford Frankfort

Classic Roadsters 1990 Sebring Healey 5000 Roadsters Classic Cars Mustang Ii

Find Out The Pros And Cons Of Leasing Vs Buying A Car Car Lease Cheap Car Insurance Car Facts